EL Members come together to discuss lottery sector trends from recently published EL Report 2021

The first webinar of the year, organised by EL and the Data & Research working group, brought together EL Members experts to learn all about the lottery sector trends identified in the recently published EL Report 2021 as well as lessons learnt and the outlook into the future.

The year 2021, as for 2020, was influenced by COVID-19 as a non-standard external factor, which impacted lotteries’ operations and performance, albeit less than in 2020. Despite the unfavourable situation, national lotteries continued to find new and innovative ways to continue to provide regulated services to their players and increased efforts to help society and impacted communities. EL Members showed their flexibility and agility, adapted to unforeseen circumstances and to stand together for the benefit of society.

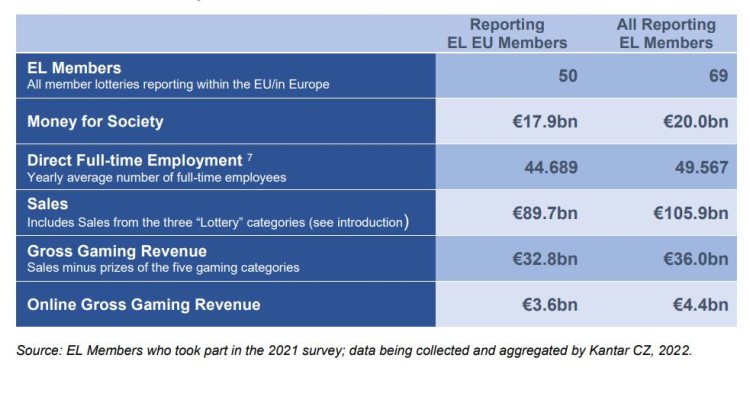

In 2021, all EL Members’ (67 reporting the category) contribution to society amounted to €20 bn, an increase of 13.0 percent compared to 2020 and of 10.0 percent compared to 2019. It means that 55.6 percent of the GGR generated by EL Members (not including sponsorships) went back to society in the respective countries. Contributions of the 49 EL Members in the EU (that reported) amounted to €17.9bn, more than 12.6 percent compared to 2020 and 10.6 percent to 2019.

The EL Report 2021 highlighted that EL Members in the EU generated sales from the three main categories of games (draw based games (DBGs), instant and sports games) amounting to €89.7bn in 2021, showing a significant increase compared to 2020 of 25.5 percent and 12.7 percent in comparison with 2019. This trend was similar when considering all EL Members, where total sales amounted to €105.8bn, resulting in a year-on-year increase of 23.1 percent in comparison with 2020 and 11.8 percent in comparison with 2019.

DBGs recovered well in 2021, when all EL Members generated GGR of €21.3bn, resulting in a year-on-year increase of 13.1 percent in comparison with 2020 and 1.1 percent in comparison with 2019 and remained the largest product vertical with 59 percent share on Total GGR. Yet, challenges remain such as global inflation and how to attract Generation Z/ Millennials.

Instant games, the second largest category hit a history maximum with more than €8.8bn, representing 24.4 percent of EL Members total GGR, an increase by 26.2 percent compared to 2020 and by 13.9 percent compared to pre-Covid year 2019 and 5.9 percent average annual growth over last five years.

In Sports Betting, all EL Members generated a total GGR of €3.2bn, representing 8.9 percent of their total GGR, an increase by 29.6 percent compared to 2020 and by 13.1 percent compared to 2019 and 6.3 percent average annual growth over last five years.

The online channel continued to grow, helped by the COVID impact on retail in 2020 and 2021, and reached the share of 16.4 percent from the total EL Members GGR in 2021.

Another important contribution of the EL Members is the contribution to employment in their respective countries. In 2021, the 48 EL Members operating in the EU directly employed 44,689 full-time employees, with all 68 reporting EL Members employed 49,567 full-time employees. The 2021 Report considered CSR topics such as diversity, equity, and inclusion, and found that out of full-time employees, women represented 50 percent.

The invited keynote speaker, Ed Birkin, Senior Analyst from H2 Gambling Capital, UK, highlighted global trends and the gaming sector outlook. H2’ sees for the period of 2022-2027 the average European annual GGR growth for DBGs 3 percent, for Instants 6 percent, for Sports Betting also 6 percent and for gaming 4 percent, inflation expected to stabilise, forecasting to lottery sector a reasonable growth perspective.

Overall, the year 2021 was very successful. EL Members recovered well from the COVID impact, generated the highest GGR year in history and succeeded to also deliver the highest amount of money for good causes, all for the benefit of society.

EL Report on the Lottery Sector in Europe 2020

Public Summary